PenFed CU Home Equity Loans Reviews 2022

Table of Content

It can range from 0% to 3.5% for government-backed loans, while conventional mortgages sometimes require as little as 3% down. Borrowers who take out an FHA loan also must have mortgage insurance. You’ll pay this as an upfront mortgage insurance premium as well as an annual mortgage insurance premium . How much house you can afford depends on several factors, including your income and DTI ratio. While you might think you’ll be able to handle a higher mortgage payment if you bring in a decent income, this is also contingent on how much of your income is already spoken for by other debts. Your debt-to-income ratio is the amount you owe on monthly debt payments compared to your income.

Homeowners with solid credit can take advantage of the credit union's reasonable interest rates and low fees that its HELOC offers. PenFed also offers a lender credit to home buyers when their mortgages close. The credit, which is available only for purchase mortgages, is $500 to $2,500, depending on the loan amount. Mortgage rates and fees are low compared with other lenders, according to the latest data. Offers a broad selection of home loan products, including low-down-payment options for first-time home buyers and HELOCs. PenFed Credit Union has a digital mortgage application, offers a wide selection of mortgages and has an open membership charter, meaning anyone is eligible to join.

What are the home equity loan requirements of PenFed CU Home Equity Loans

Outside the digital world, Marc can be found spinning vinyl, threading reel-to-reel tapes, shooting film with his Bolex and hosting an occasional pub quiz. PenFed earns 5 of 5 stars for average mortgage interest rates. To apply for a PenFed mortgage, you can call a toll-free number or fill out a form online to have a loan officer call you. You can also fill out an application for mortgage preapproval online.

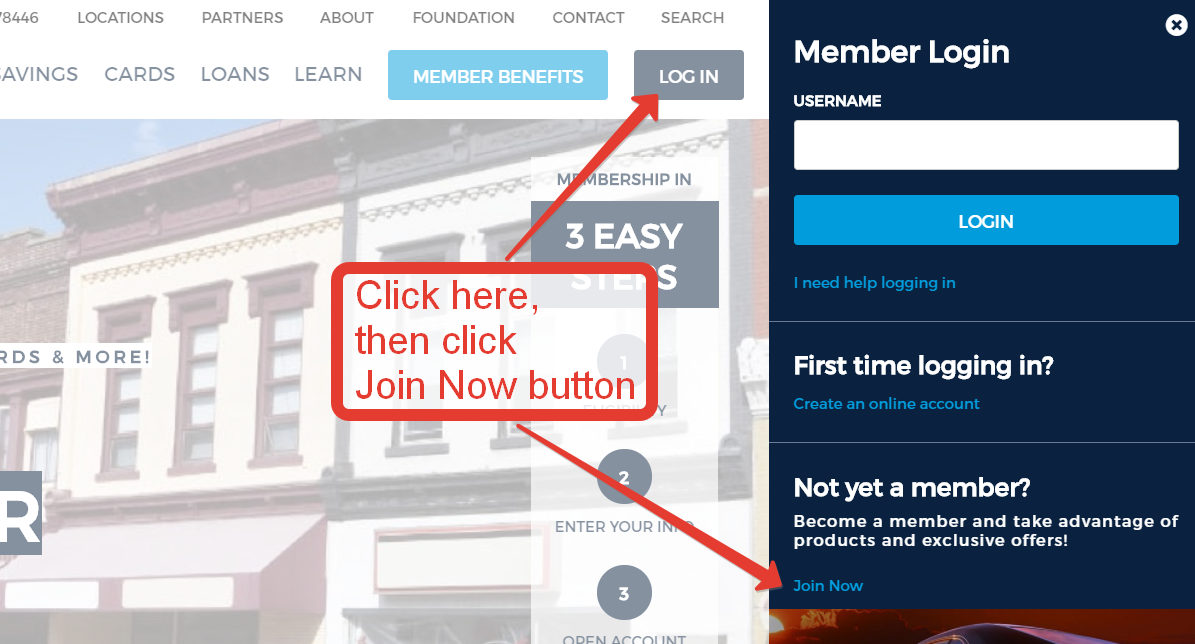

They specify a need for a “favorable” debt-to-income ratio requirement on their website. When we reached out, we were informed that the maximum debt-to-income ratio is 50 percent. PenFed also requires proof of income, at least one year of W2s, at least two months of your most recent bank account statements and a mortgage statement for all properties owned. You may also need to provide documentation for current debts and self-employment income. Also, remember that you do need to be a member of the credit union to receive funds. PenFed doesn’t charge any lender fees at closing for its HELOCs.

How to qualify for a home equity loan with PenFed

Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

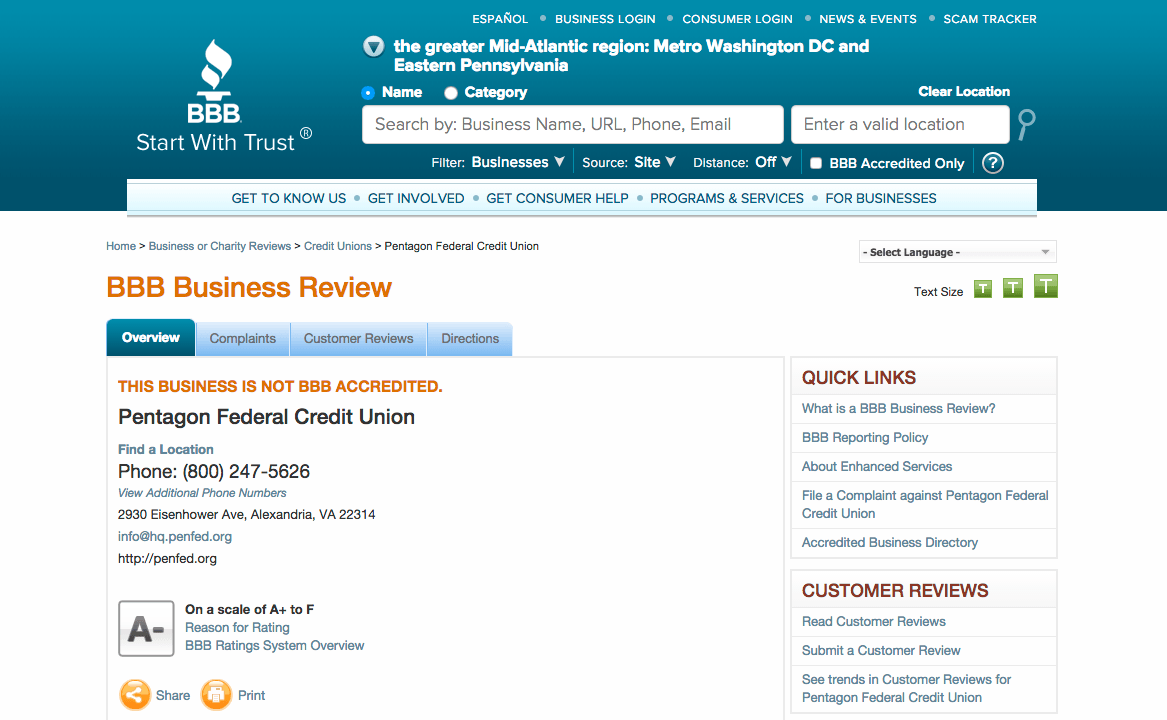

PenFed’s Better Business Bureau rating is 1.19 out of 5.0 stars, based on an average of 182 reviews as of July 7, 2022. The BBB has closed 241 complaints about the company in the last 12 months and 505 complaints in the last three years. You also have the option to call a toll-free number to ask for a loan officer to call you back. The loan officer you’re assigned to will be the one who will work with you throughout the mortgage process. This type of fee is typically 0.5% to 1% of your loan amount, so taking out a mortgage through PenFed could help you save a significant amount of money.

What fees does PenFed CU Home Equity Loans charge for a home equity loan?

Every balance subtracting transactions need OTP verification so You can feel safe about your funds. Also, you can use the google authenticator app on your cellphone and enable 2FA security from the account menu. From transferring , and receiving funds to tracking transactions, we give you access to your money anytime, anywhere. We designed our loan process to fit your needs and help you grow.

PenFed's digital capabilities allow for electronic signature, online document upload and online mortgage status updates. We provide you with the best online payment services like PayPal, Stripe, Skrill, Payeer, and RazorPay. PenFed’s Power Buyer program allows borrowers to lock their rate for 60 days. PenFed doesn’t disclose if there are any fees involved with locking your rate.

All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Keep in mind that the larger the down payment you’re able to make, the less you’ll have to finance with your mortgage. Borrowers are often advised to put at least 20% down on a conventional loan to avoid having to pay PMI.

While this is a relatively high limit, other lenders provide larger loans. This fee is only charged if you paid less than $99 in interest in the 12-month period before your account anniversary. PenFed received a customer rating of 4.54 out of 5 on Zillow, as of the date of publication. With a Penfed Credit Union PLc, you can expect a streamlined digital and mobile banking experience, with easy access to your accounts, swift and secure transfers, withdrawals, and loan.

After filling out the initial form with some basic information—including your name, phone number and property location—you’ll be contacted by a loan officer to proceed. Interest rates on PenFed mortgages are in line with national averages, as reported by Freddie Mac. Annual percentage rates —which includes the interest as well as any fees—fall below the average APR range for most mortgages.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next. Another alternative to consider is applying with a creditworthy co-signer or co-borrower. However, asking someone to share responsibility for a mortgage is no small request, especially if that person won’t even be living in the home. If you opt to get preapproved with a PenFed loan officer, you could receive a decision almost instantly, depending on the complexity of your finances. Founded in 1935 and headquartered in McLean, Virginia, Pentagon Federal Credit Union has become one of the largest credit unions in the U.S. with more than 2 million members and $31 billion in assets.

Like many other lenders, PenFed doesn’t charge any prepayment penalties on its mortgages. So if you decide to sell or refinance your home before you’ve paid off the first mortgage, you won’t have to worry about this extra cost. The only closing cost you may have to pay is an appraisal fee if you're required to do an appraisal on your property. The typical appraisal cost can range between $550 and $850.

Brno, Dec 29 – “Our single-floor units from the RegioPanter category have been in demand for regional, suburban and interurban transport in recent years. Škoda was selected as the supplier of new electrical units for the South Moravian Region last week. The Group will supply 37 RegioPanter electric units and provide full service. The value of the basic supply is more than CZK 6.5 billion. Recommendation score measures the loyalty between a provider and a consumer. It's at +100 if everybody recommends the provider, and at -100 when no one recommends.

PenFed offers a 0.99 percent introductory APR for its HELOCs, and a low 3.75 percent minimum APR after the first six months. If you have a credit score of at least 660 and are interested in becoming a PenFed Credit Union member, you should consider PenFed for your home equity borrowing needs. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including rates and fees, presented in the review is accurate as of the date of the review.

Comments

Post a Comment